[expand]

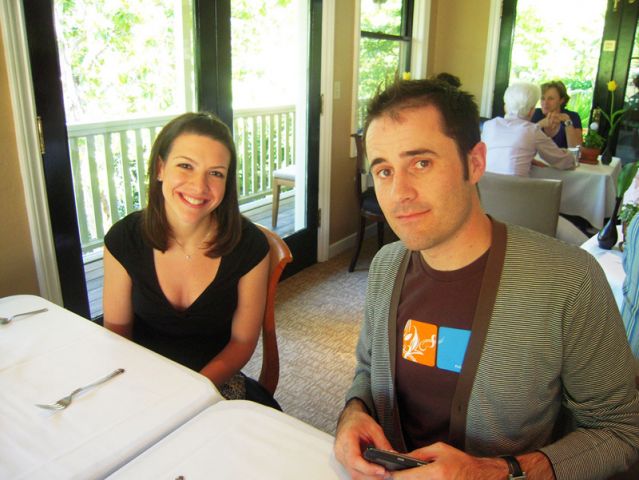

Daniel Kahneman & Richard Thaler

Edge Retreat, Spring Mountain Vineyard, Napa, California, August 22, 2013

What we're saying is that there is a technology emerging from behavioral economics. It's not only an abstract thing. You can do things with it. We are just at the beginning. I thought that the input of psychology into behavioral economics was done. But hearing Sendhil was very encouraging because there was a lot of new psychology there. That conversation is continuing and it looks to me as if that conversation is going to go forward. It's pretty intuitive, based on research, good theory, and important. — Daniel Kahneman

|

|

|

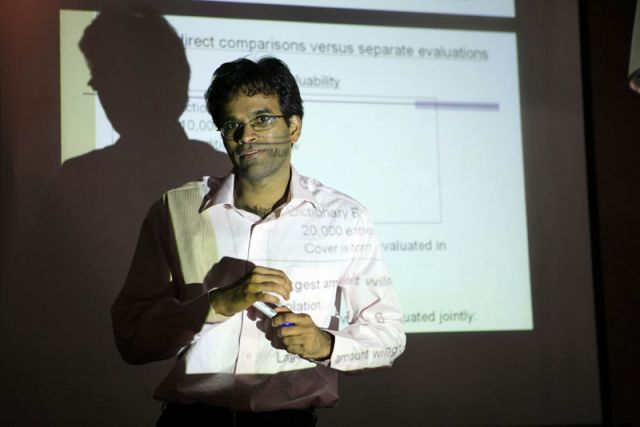

| Richard Thaler | Sendhil Mullainathan | Daniel Kahneman |

Edge Master Class 2008

Richard Thaler, Sendhil Mullainathan, Daniel Kahneman

Sonoma, CA, July 25-27, 2008

A year ago, Edge convened its first "Master Class" in Napa, California, in which psychologist and Nobel Laureate Daniel Kahneman taught a nine-hour course: "A Short Course On Thinking About Thinking." The attendees were a "who's who" of the new global business culture.

The following year, in 2008, we invited Richard Thaler, the father of behavioral economics, to continue the conversation by organizing and leading the class: "A Short Course On Behavioral Economics."

Thaler arrived at Stanford in the 1970s to work with Kahneman and his late partner, Amos Tversky. Thaler, in turn, asked Harvard economist and former student Sendhil Mullainathan, as well as Kahneman, to teach the class with him.

The entire text to the 2008 Master Class is available online, along with video highlights of the talks and a photo gallery. The text also appears in a book privately published by Edge Foundation, Inc.

|

|

|

| Nathan Myhrvold | Jeff Bezos | Elon Musk |

Whereas the focus for Kahneman's 2007 Master Class was on psychology, in 2008 the emphasis shifted to behavioral economics. As Kahneman noted: "There's new technology emerging from behavioral economics, and we are just starting to make use of that. I thought the input of psychology into economics was finished, but clearly it's not!"

The Master Classes are the most recent iteration in Edge's development, which began its activities under the name "The Reality Club" in 1981. Edge is different from The Algonquin, The Apostles, The Bloomsbury Group, or The Club, but it offers the same quality of intellectual adventure. The closest resemblances are to The Invisible College and the Lunar Society of Birmingham.

In contemporary terms, this results in Edge having a Google PageRank of "8," the same as The Atlantic, Corriere della Sera, The Economist, the Financial Times, Le Monde, The New Yorker, the New Statesman, Vanity Fair, the Wall Street Journal, the Washington Post, among others.

The early seventeenth-century Invisible College was a precursor to the Royal Society. Its members consisted of scientists such as Robert Boyle, John Wallis, and Robert Hooke. The Society's common theme was to acquire knowledge through experimental investigation. Another example is the nineteenth-century Lunar Society of Birmingham, an informal club of the leading cultural figures of the new industrial age—James Watt, Erasmus Darwin, Josiah Wedgwood, Joseph Priestley, and Benjamin Franklin.

In a similar fashion, Edge, through its Master Classes, gathers together intellectuals and technology pioneers. George Dyson, in his summary (below) of the second day of the proceedings, writes:

Retreating to the luxury of Sonoma to discuss economic theory in mid-2008 conveys images of Fiddling while Rome Burns. Do the architects of Microsoft, Amazon, Google, PayPal, and Facebook have anything to teach the behavioral economists—and anything to learn? So what? What's new?? As it turns out, all kinds of things are new. Entirely new economic structures and pathways have come into existence in the past few years.

Indeed, as one distinguished European visitor noted, the weekend, which involved the two-day Master Class in Sonoma followed by a San Francisco dinner, was "a remarkable gathering of outstanding minds. These are the people that are rewriting our global culture."

— John Brockman, Editor

|

|

|

| Sean Parker | Salar Kamangar | Evan Williams |

RICHARD H. THALER is the Ralph and Dorothy Keller Distinguished Service Professor of Behavioral Science and Economics at Chicago's Booth School of Business and director of the University of Chicago’s Center for Decision Research. He is coauthor (with Cass Sunstein) of Nudge: Improving Decisions About Health, Wealth, and Happiness, and author of Misbehaving. Thaler is the recipient of the 2017 Nobel Prize in economics. Richard Thaler's Edge Bio Page

SENDHIL MULLAINATHAN, a professor of economics at Harvard, a recipient of a MacArthur Foundation "genius grant," conducts research on development economics, behavioral economics, and corporate finance. His work concerns creating a psychology of people to improve poverty alleviation programs in developing countries. He is executive director of Ideas 42, Institute of Quantitative Social Science, Harvard University. Sendhil Mullainathan's Edge Bio Page

DANIEL KAHNEMAN, a psychologist at Princeton University, is the recipient of the 2002 Nobel Prize in Economics for his pioneering work integrating insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty. Daniel Kahneman's Edge Bio page

|

|

| George Dyson | Salar Kamangar, Evan Williams, Elon Musk, Katinka Matson |

PARTICIPANTS: Jeff Bezos, Founder, Amazon.com; John Brockman, Edge Foundation, Inc.; Max Brockman, Brockman, Inc.; George Dyson, Science Historian; Author, Darwin Among the Machines; W. Daniel Hillis, Computer Scientist; Cofounder, Applied Minds; Author, The Pattern on the Stone; Daniel Kahneman, Psychologist; Nobel Laureate, Princeton University; Salar Kamangar, Google; France LeClerc, Marketing Professor; Katinka Matson, Edge Foundation, Inc.; Sendhil Mullainathan, Professor of Economics, Harvard University; Executive Director, Ideas 42, Institute of Quantitative Social Science; Elon Musk, Physicist; Founder, Tesla Motors, SpaceX; Nathan Myhrvold, Physicist; Founder, Intellectual Venture, LLC; Event Photographer; Sean Parker, The Founders Fund; Cofounder: Napster, Plaxo, Facebook; Paul Romer, Economist, Stanford; Richard Thaler, Behavioral Economist, Director of the Center for Decision Research, University of Chicago Graduate School of Business; coauthor of Nudge; Anne Treisman, Psychologist, Princeton University; Evan Williams, Founder, Blogger, Twitter.

Further Reading on Edge:

"A Short Course In Thinking About Thinking"

Edge Master Class 2007

Daniel Kahneman

Auberge du Soleil, Rutherford, CA, July 20-22, 2007

A SHORT COURSE IN BEHAVIORAL ECONOMICS

CLASS ONE • CLASS TWO • CLASS THREE • CLASS FOUR • CLASS FIVE • CLASS SIX

PHOTO GALLERY

LIBERTARIAN PATERNALISM: WHY IT IS IMPOSSIBLE NOT TO NUDGE

(Class 1)

A Talk By Richard Thaler

Danny Hillis, Nathan Myhrvold, Daniel Kahneman, Jeff Bezos, Sendhil Mullainathan

If you remember one thing from this session, let it be this one: There is no way of avoiding meddling. People sometimes have the confused idea that we are pro meddling. That is a ridiculous notion. It's impossible not to meddle. Given that we can't avoid meddling, let's meddle in a good way. — Richard Thaler

IMPROVING CHOICES WITH MACHINE READABLE DISCLOSURE

(Class 2)

A Talk By Richard Thaler & Sendhil Mullainathan

Jeff Bezos, Nathan Myhrvold, Salar Kamangar, Daniel Kahneman, Danny Hillis, Paul Romer, Elon Musk, Sean Parker

At a minimum, what we're saying is that in every market where there is now required written disclosure, you have to give the same information electronically, and we think intelligently how best to do that. In a sentence that's the nature of the proposal.— Richard Thaler

THE PSYCHOLOGY OF SCARCITY

(Class 3)

A Talk By Sendhil Mullainathan

Nathan Myhrvold, Richard Thaler, Daniel Kahneman, France LeClerc, Danny Hillis, Paul Romer, George Dyson, Elon Musk, Jeff Bezos, Sean Parker

Let's put aside poverty alleviation for a second, and let's ask, "Is there something intrinsic to poverty that has value and that is worth studying in and of itself?" One of the reasons that is the case is that, purely aside from magic bullets, we need to understand if there unifying principles under conditions of scarcity that can help us understand behavior and to craft intervention. If we feel that conditions of scarcity evoke certain psychology, then that, not to mention pure scientific interest, will affect a vast majority of interventions. It's an important and old question.

TWO BIG THINGS HAPPENING IN PSYCHOLOGY TODAY

(Class 4)

A Talk By Daniel Kahneman

Danny Hillis, Richard Thaler, Nathan Myhrvold, Elon Musk, France LeClerc, Salar Kamangar, Anne Treisman, Sendhil Mullainathan, Jeff Bezos, Sean Parker

There's new technology emerging from behavioral economics and we are just starting to make use of that. I thought the input of psychology into economics was finished but clearly it's not!

THE REALITY CLUB

W. Daniel Hillis, Daniel Kahneman, Nathan Myhrvold, Richard Thaler on "Two Big Things Happening In Psychology Today"

THE IRONY OF POVERTY

(Class 5)

A Talk By Sendhil Mullainathan

Daniel Kahneman, Paul Romer, Richard Thaler, Danny Hillis, Jeff Bezos, Sean Parker, Anne Treisman, France LeClerc, Salar Kamangar, George Dyson

I want to close a loop, which I'm calling "The Irony of Poverty." On the one hand, lack of slack tells us the poor must make higher quality decisions because they don't have slack to help buffer them with things. But even though they have to supply higher quality decisions, they're in a worse position to supply them because they're depleted. That is the ultimate irony of poverty. You're getting cut twice. You are in an environment where the decisions have to be better, but you're in an environment that by the very nature of that makes it harder for you apply better decisions.

PUTTING PSYCHOLOGY INTO BEHAVIORAL ECONOMICS

(Class 6)

A Talk By Richard Thaler, Daniel Kahneman, Sendhil Mullainathan

Richard Thaler, Daniel Kahneman, Sendhil Mullainathan, Sean Parker, Anne Treisman, Paul Romer, Danny Hillis, Jeff Bezos, Salar Kamangar, George Dyson, France LeClerc

There's new technology emerging from behavioral economics and we are just starting to make use of that. I thought the input of psychology into economics was finished but clearly it's not!

PHOTO GALLERY

Edge Master Class & San Francisco Dinner

Photo Gallery: A Short Course In Behavioral Economics (Below)

Photo Gallery: The San Francisco 2008 Science Dinner

INTRODUCTION

By Daniel Kahneman

Many people think of economics as the discipline that deals with such things as housing prices, recessions, trade and unemployment. This view of economics is far too narrow. Economists and others who apply the ideas of economics deal with most aspects of life. There are economic approaches to sex and to crime, to political action and to mass entertainment, to law, health care and education, and to the acquisition and use of power. Economists bring to these topics a unique set of intellectual tools, a clear conception of the forces that drive human action, and a rigorous way of working out the social implications of individual choices. Economists are also the gatekeepers who control the flow of facts and ideas from the worlds of social science and technology to the world of policy. The findings of educators, epidemiologists and sociologists as well as the inventions of scientists and engineers are almost always filtered through an economic analysis before they are allowed to influence the decisions of policy makers.

In performing their function as gatekeepers, economists do not only apply the results of scientific investigation. They also bring to bear their beliefs about human nature. In the past, these beliefs could be summarized rather simply: people are self-interested and rational, and markets work. The beliefs of many economists have become much more nuanced in recent decades, and the approach that goes under the label of “behavioral economics” is based on a rather different view of both individuals and institutions. Behavioral economics is fortunate to have a witty guru—Richard Thaler of the University of Chicago Business School. (I stress this detail of his affiliation because the Economics Department of the University of Chicago is the temple of the “rational-agent model” that behavioral economists question.) Expanding on the idea of bounded rationality that the polymath Herbert Simon formulated long ago, Dick Thaler offered four tenets as the foundations of behavioral economics:

Bounded rationality

Bounded selfishness

Bounded self-control

Bounded arbitrage

The first three bounds are reasonably self-evident and obviously based on a plausible view of the psychology of the human agent. The fourth tenet is an observation about the limited ability of the market to exploit human folly and thereby to protect individual fools from their mistakes. The combination of ideas is applicable to the whole range of topics to which standard economic analysis has been applied—and at least some of us believe that the improved realism of the assumption yields better analysis and more useful policy recommendations.

Behavioral economics was influenced by psychology from its inception—or perhaps more accurately, behavioral economists made friends with psychologists, taught them some economics and learned some psychology from them. The little economics I know I learned from Dick Thaler when we worked together twenty-five years ago. It is somewhat embarrassing for a psychologist to admit that there is an asymmetry between the two disciplines: I cannot imagine a psychologist who could be counted as a good economist without formal training in that discipline, but it seems to be easier for economists to be good psychologists. This is certainly the case for both Dick and Sendhil Mullainathan—they know a great deal of what is going on in modern psychology, but more importantly they have superb psychological intuition and are willing to trust it.

Some of Dick Thaler’s most important ideas of recent years—especially his elaboration of the role of default options and status quo bias—have relied more on his flawless psychological sense than on actual psychological research. I was slightly worried by that development, fearing that behavioral economics might not need much input from psychology anymore. But the recent work of Sendhil Mullainathan has reassured me on this score as well as on many others. Sendhil belongs to a new generation. He was Dick Thaler’s favorite student as an undergraduate at Cornell, and his wonderful research on poverty is a collaboration with a psychologist, Eldar Shafir, who is roughly my son’s age. The psychology on which they draw is different from the ideas that influenced Dick. In the mind of behavioral economists, young and less young, the fusion of ideas from the two disciplines yields a rich and exciting picture of decision making, in which a basic premise—that the immediate context of decision making matters more than you think—is put to work in novel ways.

I happened to be involved in an encounter that had quite a bit to do with the birth of behavioral economics. More than twenty-five years ago, Eric Wanner was about to become the President of the Russell Sage Foundation—a post he has held with grace and distinction ever since. Amos Tversky and I met Eric at a conference on Cognitive Science in Rochester, where he invited us to have a beer and discuss his idea of bringing together psychology and economics. He asked how a foundation could help. We both remember my answer. I told him that this was not a project on which it was possible to spend a lot of money honestly. More importantly, I told him that it was futile to support psychologists who wanted to influence economics. The people who needed support were economists who were willing to be influenced. Indeed, the first grant that the Russell Sage Foundation made in that area allowed Dick Thaler to spend a year with me in Vancouver. This was 1983-1984, which was a very good year for behavioral economics. As the Edge Sonoma session amply demonstrated, we have come a long way since that day in a Rochester bar.

FIRST DAY SUMMARY—EDGE MASTER CLASS 2008

By Nathan Myhrvold

DR. NATHAN MYHRVOLD is CEO and managing director of Intellectual Ventures, a private entrepreneurial firm. Before Intellectual Ventures, Dr. Myhrvold spent fourteen years at Microsoft Corporation. In addition to working directly for Bill Gates, he founded Microsoft Research and served as Chief Technology Officer.

Nathan Myhrvold's Edge Bio Page

____________________________

The recent Edge event on behavioral economics was a great success. Here is a report on the first day.

Over the course of the last few years we've been treated to quite a few expositions of behavioral economics—probably a dozen popular books seek to explain some aspect of the field. This isn't the place for a full summary but the gist is pretty simple. Classical economics has studied a society of creatures that Richard Thaler, an economist at University of Chicago dubs the "Econ." Econs are rather superhuman in some ways—they do everything by optimizing utility functions, paragons of bounded rationality. Behavioral economics is about understanding how real live Humans differ from Econs.

In previous reading, and an Edge event last year I learned the most prominent differences between Econs and Humans. Humans, as it turns out, are not always bounded rational—they can be downright irrational. Thaler likes to say that Humans are like Homer Simpson. Econs are like Mr. Spock. This is a great start, but to have any substance in economics one has to understand that in the context of economic situations. Humans make a number of systematic deviations from the Econ ideal, and behavioral economics has categorized a few of these. So, for example, we humans fear loss more than we love gain. Humans care about how a question is put to them—propositions that an Econ would instantly recognize as mathematically equivalent seem different to Humans and they behave differently.

Daniel Kahneman, a Nobel laureate for his work in behavioral economics told us about priming—how a subtle influence radically shifts how people act. So, in one experiment people are asked to fill out a survey. In the corner of the room is a computer, with a screen saver running. That's it—nothing overt, just a background image in the room. If the screen saver shows pictures of money, the survey answers are radically different. Danny went through example after example like this where occurred. The first impulse one has in hearing this is no, this can't be the case. People can't be that easily and subconsciously influenced. You don't want to believe it. But Danny in his professorial way says, "Look, this is science. Belief isn't an option. Repeated randomized trials confirm the results. Get over it." The second impression is perhaps even more surprising—the influences are quite predictable. Show people images of money, and they tend to be more selfish and less willing to help others. Make people plot points on graph paper that are far apart, and they act more distant in lots of way. Make them plot points that are close together, and damned if they don't act closer. Again, it seems absurd, but cheap metaphors capture our minds. Humans, it seems, are like drunken poets, who can't glimpse a screen saver in the corner, or plot some points on graph paper without swooning under the metaphorical load and going off on tangents these stray images inspire.

This is all very strange, but is it important? The analogy that seems most apt to me is optical illusions. An earlier generation of psychologists got very excited about how the low level visual processing in our brains is hardwired to produce paradoxical results. The priming stories seem to me to be the symbolic and metaphorical equivalent. The priming metaphors in optical illusions are the context of the image—the extra lines or arrows that fool us into making errors in judgment of sizes or shapes. While one can learn to recognize optical illusions, you can't help but see the effect for what it is. Knowing the trick does not lessen its intuitive impact. You really cannot help but think one line is longer, even if you know that the trick will be revealed in a moment.

I wonder how closely this analogy carries over. Danny said today that you couldn't avoid priming. If he is right perhaps the analogy is close; but perhaps it's not.

I also can't help but wonder how important these effects are to thinking and decision making in general. After the early excitement about optical illusions, they have retreated from prominence—they explain a few cute things in vision, but they are only important in very artificial cases. Yes, there are a few cases where product design, architecture and other visual design problems are impacted by optical illusions, but very few. In most cases the visual context is not misleading. So, while it offers an interesting clue to how visual processing works, it is a rare special case that has little practical importance.

Perhaps the same thing is true here—the point of these psychological experiments, like the illusions, is to isolate an effect in a very artificial circumstance. This is a great way to get a clue about how the brain works (indeed it would seem akin to Steven Pinker's latest work The Stuff of Thought which argues for the importance of metaphors in the brain). But is it really important to day-to-day real world thinking? In particular, can economics be informed by these experiments? Does behavioral economics produce a systematically different result that classical economics if these ideas are factored in?

I can imagine it both ways. If it is important, then we are all at sea, tossed and turned in a tumultuous tide of metaphors imposed by our context. That is a very strange world—totally counter to our intuition. But maybe that is reality.

Or, I could equally imagine that it only matters in cases where you create a very artificial experiment—in effect, turning up the volume on the noise in the thought process. In more realistic contexts the signal trumps the noise.

The truth is likely some linear combination of these two extreme—but what combination? There are some great experiments yet to be done to nail that down.

Dick Thaler gave a fascinating talk that tries to apply these ideas in a very practical way. There is an old debate in economics about the right way to regulate society. Libertarians would say don't try—the harm in reducing choice is worse than the benefit, in part because of unintended consequences, but mostly because the market will reach the right equilibrium. Marxist economists, at the other extreme, took it for granted that one needs a dictatorship of the proletariat—choice is not an option, at least for the populace. Thaler has a new creation—a concept he calls "libertarian paternalism" which tries to split the baby.

The core idea (treated fully in his book Nudge) is pretty simple—present plenty of options, but then encourage certain outcomes by using behavioral economics concepts to stack the deck. A classic example is the difference between opt-in and opt-out in a program such as organ donation. If you tell people that they can opt-in to donating their organs if they are killed, a few will feel strongly enough to do it—most people won't. If you switch that to opt-out the reverse happens—very few people opt out. Changing the "choice architecture" that people have changes choices. This is not going to work on people who feel strongly, but the majority doesn't really care and can be pushed in one direction or another by choice architecture.

A better example is a program called "save more tomorrow" (SMT), for 401K plans in companies. People generally don't save very much. So, the "save more tomorrow" program lets you decide up front to save a greater portion of promotions and raises. You are not cutting into today's income (to which you feel you are entitled to spend) but rather you are pre-allocating a future windfall. Seems pretty simple but there are dramatic increases in savings rates when it is instituted.

Dick came to the session loaded for bear, expecting the objections of classical economics. Apparently this is all very controversial among economists and policy wonks. It struck me as very clever, but once explained, very obvious. Of course you can put some spin on the ball and nudge people the right way using to achieve a policy effect. It's called marketing when you do this in business, and it certainly can matter. In the world of policy wonk economists this may be controversial, but it wasn't to me.

An interesting connection with the discussion of priming experiments is that many policy contexts are highly artificial—very much like experiments. Filling out a driver's license form is a kind of questionnaire, and the organ donation scenario seems very remote to most people despite the fact that they're making a binding choice. The mechanics of opt-in versus opt-out or required choice could matter a lot in these contexts.

Dick has a bunch of other interesting ideas. One of them is to require that government disclosures on things like cell phone plans, or credit card statements be machine-readable disclosure with a standard schema. This would allow web sites to offer automated comparisons, and other tools to help people understand the complexities.

This is a fascinating idea that could have a lot of merit. Dick is, from my perspective, a bit over optimistic in some ways—it is unclear that it will be overwhelming. An example is unit prices in grocery stores—those little labels on store shelves that tell you that Progesso canned tomatoes are fifty-seven cents per pound, while the store brand is forty-three. Consumer advocates thought these would revolutionize consumer behavior—and perhaps they did in some limited ways. But premium brands didn't disappear.

I also differ on another point—must this be required by government, and would it be incorruptible were it so mandated. In the world of technology most standards are de facto, rather than de juris, and are driven by private owners (companies or private sector standards bodies), because the creation and maintenance of a standard is a dynamic balancing act—not static one. I think that many of the disclosure standards he seeks would be better done this way. Conversely, a government mandate disclosure standard might become so ossified by changing slowly that it did not achieve the right result. Nevertheless, this is a small point compared to the main idea, which is that machine-readable disclosures with standardized schema allow third party analysis and enables a degree of competition that would harder to achieve by other means.

Sendhil Mullainathan gave a fascinating talk about applying behavior economics to understand poverty. If this succeeds (it is a work in progress) it would be extremely important.

He showed a bunch of data on itinerant fruit vendors (all women) in India. Sixty-nine percent of them are constantly in debt to moneylenders who charge 5% per day interest. The fruit ladies make 10% per day profit, so half their income goes to the moneylender. They also typically buy a couple cups of tea per day. Sendhil shows that 1-cup of tea per day less would let them be debt free in thirty days, doubling their income. Thirty-one percent of these women have figured that out, so it is not impossible. Why don't the rest get there?

Sendhil then showed a bunch of other data arguing that poor people—even those in the US (who are vastly richer in absolute scale than his Indian fruit vendors)—do similar things with how they spend food stamps, or use of payday loans. He was very deliberate at drawing this out, until I finally couldn't stand it and blurted out "you're saying that they all have high discount rate". His argument is that under scarcity there is a systematic effect that you put the discount rate way too high for your own good. With too high a discount rate, you spend for the moment, not for the future. So, you have a cup a tea rather than double your income.

He is testing this with an amazing experiment. What would these women do if they could escape the "debt trap"? Bono, Jeffery Sachs and others have argued this point for poor nations—this is the individual version of the proposition.

Sendhil is studying 1000 of these fruit vendors (all women). Their total debt is typically $25 each, so he is just stepping in and paying off the debt for 500 of them! The question is then to see how many of them revert to being in debt over time, versus the 500 who are studied, but do not have their debt paid off. The experiment is underway and he has no idea what the result will be.

The interesting thing here is that, for these people, one can do a meaningful experiment (N = 500 gives good statistics) without much money in absolute. It would be hard to do this experiment with debt relief for poor nations, or even the US poor, but in India you can do serious field experiments for little money.

Sendhil also has an amusing argument, which is that very busy people are exactly like these poor fruit vendors. If you have very little time, it is scarce and you are as time-poor as the fruit ladies are cash-poor. So, you act like there is a high discount—and you commit to future events—like agreeing to travel and give a talk. Then as the time approaches, you tend to regret it and ask, "Why did I agree to this?" So you act like there is a high discount rate. This got everybody laughing. The difference here is that time can't be banked or borrowed, so it is unclear to me how close an analogy it is, but it was interesting nonetheless.

Indeed, I almost cancelled my attendance at this event right before hand, thinking, "why did I agree to this? I don't have the time!" After much wrestling I decided I could attend the first day, but no more. Well, this is one of those times when having the "wrong" discount rate is in your favor. I'm very glad I attended.

— Nathan Myhrvold

SECOND DAY SUMMARY—EDGE MASTER CLASS 2008

By George Dyson

GEORGE DYSON, a historian among futurists, is the author Baidarka; Project Orion; and Darwin Among the Machines.

____________________________

The weekend master class on behavioral economics was productive in unexpected ways, and a lot of good ideas and thoughts about implementing them were exchanged.

Day two (Sunday) opened with a session led by Sendhil Mullainathan, followed by a final wrap-up discussion before we adjourned at noon. Elon Musk, Evan Williams, and Nathan Myhrvold had departed early. In the absence of Nathan's high-resolution record, a brief summary, with editorial comments, is given here.

"I refuse to accept however, the stupidity of the Stock Exchange boys, as an explanation of the trend of stocks," wrote John von Neumann to Stanislaw Ulam, on December 9, 1939. "Those boys are stupid alright, but there must be an explanation of what happens, which makes no use of this fact." This question led von Neumann (with the help of Oskar Morgenstern) to his monumental Theory of Games and Economic Behavior, a precise mathematical structure demonstrating that a reliable economy can be constructed out of unreliable parts.

The von Neumann and Morgenstern approach (developed further by von Neumann's subsequent Probabilistic Logics and the Synthesis of Reliable Organisms From Unreliable Components) assumes that human unreliability and irrationality (by no means excluded from their model) will, in the aggregate, be filtered out. In the real world, however, irrational behavior (including the "stupidity of the stock exchange boys") is not completely filtered out. Daniel Kahneman, Richard Thaler, Sendhil Mullainathan, and their colleagues are developing an updated theory of games and economic behavior that does make use of this fact.

Sendhil Mullainathan opened the first hour, on the subject of scarcity, by repeating the first day's question: what is it that prevents the fruit vendors (who borrow their working capital daily at high interest) from saving their way out of recurring debt? According to Sendhil, many vendors do manage to escape, but a core-group remains trapped.

Sendhil shows a graph with $$ on the X-axis and Temptation on the Y-axis. The curve starts out flat and then ascends steeply upward before leveling off. The dangerous area is the steep slope when a person begins to acquire disposable income and meets rapidly increasing temptations. "To understand the behavior you have to understand the scale." Thaler interjects: "It's a mental accounting problem—but I think everything is a mental accounting problem." All human beings are subject to temptation, but the consequences are higher for the poor. Conclusion: temptation is a regressive tax.

Paul Romer notes that the temptation of time is a progressive tax, since time, unlike money, is evenly distributed, and wealthy people, no matter how well supplied with money, believe they have less spare time. Bottom line: the effects of temptation do not scale with income.

How best to intervene? Daniel Kahneman notes: "Some cultures have solved that problem... there seems to be a cultural solution." Sendhil, whose field research may soon have some answers, believes that lending at lower interest rates may help but will not solve the problem, and adds: "It would be better for the micro-financiers to come in and offer money at the same rate as the existing lenders, and then make the payoff in some other ways." The problem is the chronic effects of poverty, not the lending institutions (or lack thereof).

Sendhil moves the discussion to the subject of "depletion"—when judgment deteriorates due to the effects of stress. Clinical studies and real-world examples are described. Mental depletion correlates strongly with high serum cortisol (measurable in urine) and low glucose. Poverty produces chronic depletion, and decisions are impaired. High-value decisions are made under conditions of high stress. This results in what Sendhil terms the scarcity trap.

During the mid-morning break (with cookies), Richard Thaler shows videos from a forty-year-old study (Walter Mischel, 1973) of children offered one cookie now or two if they wait. The observed behavior correlates strongly, by almost any measure, with both the economic success of the parents and the child's future success. Hypothesis: small behavioral shifts might produce (or "nudge") large economic results.

After the break we begin to wrap things up. Richard Thaler suggests a "nudge" model of the world. The same way a digital camera has both an "expert mode" and an "idiot mode," what the economy needs is an "idiot mode" resistant to experts making mistakes.

Thaler notes that Government is really bad at building systems that can be operated in "idiot mode"—just compare private sector websites vs. public sector. Imagine if the Government had designed the user interface for Amazon!

Sendhil makes a final comment that elicits agreement all around: "R&D in the poverty space has huge potential returns and there is too little thinking about that."

Daniel Kahneman concludes: "There's new technology emerging from Behavioral Economics and we are just starting to make use of that. I thought the input of psychology into economics was finished but clearly it's not!" The meeting adjourns.

My personal conclusions: retreating to the luxury of Sonoma to discuss economic theory in mid-2008 conveys images of Fiddling while Rome Burns. Do the architects of Microsoft, Amazon, Google, PayPal, and Facebook have anything to teach the behavioral economists—and anything to learn? So what? What's new?? As it turns out, all kinds of things are new. Entirely new economic structures and pathways have come into existence in the past few years. More wealth is flowing ever more quickly, and can be monitored and influenced in real time. Models can be connected directly to the real world (for instance, Sendhil's field experiment, using real money to remove real debt, observing the results over time). The challenge is how to extend the current economic redistribution as efficiently (and beneficently) as possible to the less wealthy as well as the wealthy of the world.

A time of misguided economic decisions, while bad for many of us, is a good time for behavioral economics. As Abraham Flexner argued (26 September 1931) when urging the inclusion of a School of Economics at the founding of the Institute for Advanced Study: "The plague is upon us, and one cannot well study plagues after they have run their course." All the more so amidst the plagues of 2008.

It was Louis Bamberger's wish (23 April 1934), upon granting Abraham Flexner's request, that "the School of Economics and Politics may contribute not only to a knowledge of these subjects but ultimately to the cause of social justice which we have deeply at heart."